Year at a Glance

1,823

STUDENTS

$100,000

in scholarship

funds awarded

78

SCHOLARSHIP

WINNERS

1,145

SmartBenefit cards

and 125 Kids-Ride-Free

were

provided to

students

683

were assisted with

obtaining health

care

coverage

Message from the

CEO and Board Chair

Dear Friends,

As we reflect on the past year, we are filled with a deep sense of accomplishment and optimism. Carlos Rosario School remains steadfast in our mission to provide exceptional education and workforce development training to immigrant learners, fostering an inclusive and empowering environment where every student can thrive.

Our annual report illustrates the transformative impact of our learners’ determination and our work together, including your support. It showcases the milestones we have achieved together and shares the stories of the lives we have touched through our life-changing programs. Thanks to your support, we have been able to provide a nurturing space for students from diverse backgrounds to learn, grow, and achieve their dreams.

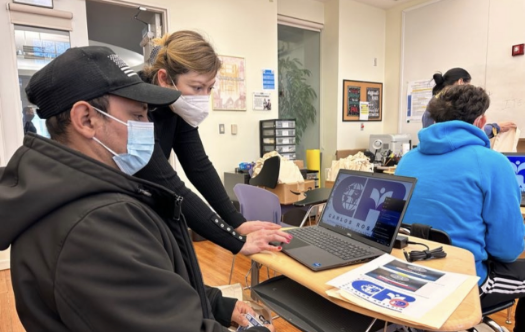

In the face of unique challenges brought about by the pandemic, Carlos Rosario School demonstrated resilience and adaptability. Our dedicated educators and staff embraced a new school model, ensuring that our students continued to receive a quality education despite the disruptions. With your help, we swiftly transitioned to online learning platforms, equipped every student with an internet-enabled laptop, and offered additional resources to bridge the digital divide for our students.

The Carlos Rosario School model is critically important, now more than ever, and we need your continued partnership. As the District faces new economic realities, as Artificial Intelligence impacts the labor market, as digital skills for all workers become required in order to access job opportunities, we need to ensure our students are not left behind. The digital skills and language skills our learners gain at our School empower them to pursue opportunities that will put them on the path to employment and upward mobility.

As we embark on another year of excellence, we invite you to join us on this remarkable journey. Your continued support and partnership are instrumental in ensuring that we can reach even greater heights and make an enduring impact on the lives of countless students. Together, let us nurture a diverse community where everyone has the opportunity to shine. With heartfelt gratitude,

Allison R. Kokkoros, CEO

Jim Moore, Board Chair

Our Top Program Enrollment

Demographics

Age

Gender

Gender data is based on student selected gender identity.

We have one student self-reporting as non-binary.

Female

Male

Non-Binary

Country of Birth

El Salvador

Ethiopia

Honduras

Guatemala

Mexico

Length of U.S. Residency

1-2 Years

3-5 Years

6-10 Years

11-20 Years

21+ Years

Level of Education

8th Grade or Less

Some HS

HS Diploma/GED

Some College

AA/AS Degree

BA/BS Degree

Master’s

JD

MD

PhD

None Indicated

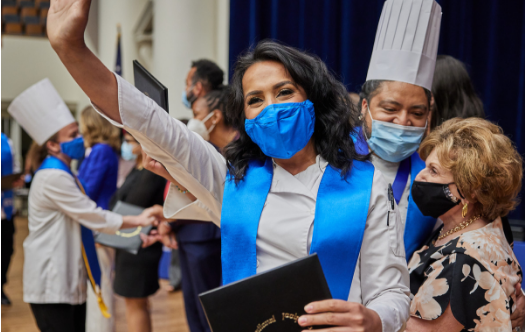

Student & Alumni

Success Stories

HANG HOANG

Culinary Arts Program Graduate

”I am so thankful to have attended Carlos Rosario School, where my success would have been incomplete without the friends, teachers I met and the things that I learned through my time there.”

Read More

HYPPOLITE

IT Fundamentals Training Program Graduate

”They were very supportive during the whole program. The school provided all the materials, computer, and internet. We also received training in how to build a resume and thanks to all this support I was able to achieve my goal.”

Read More

KORINA JIMENEZ

Bilingual Teacher Assistant Program Graduate

”The first time I crossed over the main doors of the school, I felt the power of the opportunities that Carlos Rosario has for each of us. They became part of my life.”

Read MoreView All Student Success Stories

Achieving the Dream (ATD)

Featured Scholar

Stories

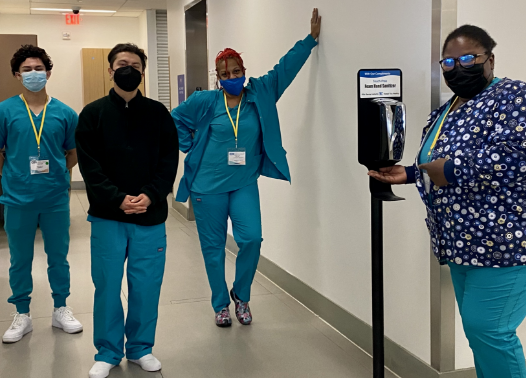

Meet Josephine

Josephine from Yaoundé, Cameroon, came to the U.S. in 2014. From her

teenage years, Josephine dreamed of being a nurse. She enrolled and graduated from the Carlos

Rosario School’s Nurse Aide Training program.

A Carlos Rosario School Achieving The Dream Scholarship program recipient, Josephine completed

her nursing program at Montgomery College, and became a full time Registered Nurse at the

Washington Hospital Center.

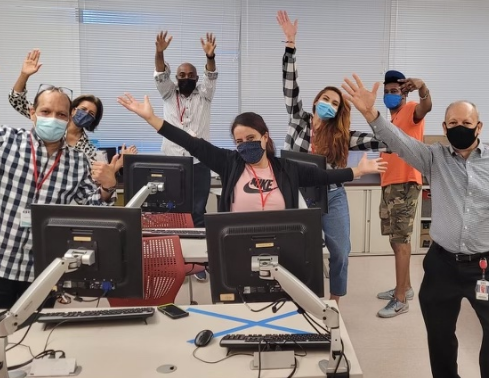

Meet Jose

José never pictured himself as a college student, but his journey at

the Carlos Rosario School led him to make the unexpected choice of returning to school. He broke

through barriers to become the first person in his family to pursue higher education, something

that was unimaginable to him only a few years ago.

Jose was awarded a scholarship through the Carlos Rosario School’s Scholarship Program. Thanks

to this, José was able to begin his studies in Computer Sciences at the University of the

District of Columbia (UDC).

Meet Amy

Born and raised in San Pedro Sula, Honduras, Any moved to the United

States in 2015. She enrolled as a student at the Carlos Rosario School and took ESL classes, the

Math for Life and Work class, and the Bilingual Teaching Assistant Program.

Since graduation, Any has worked at the Mundo Verde Public Charter School as a Teaching Fellow.

She is currently continuing her studies at University of the District of Columbia (UDC) thanks

to a Carlos Rosario School Achieving the Dream Scholarship.

Carlos Rosario School Board of Trustees

- James Moore, Chair

- Hector Torres, Vice-Chair

- Robbie Dean, Secretary

- Yeshimebeth T. Belay (Mama Tutu), Member

- Allison R. Kokkoros, Ex-Officio Member

- Ana Mejia, Member

- Teresita Retana Piedra, Member

- Vilma Rosario, Member

- Johan Uvin, Member

- Larry Villegas, Member

Honorary Members Emeritus

Jane García • Alberto Gómez • Sonia Gutiérrez • Pedro Luján♰